Broadcom(AVGO), a semiconductor powerhouse, dominates the tech industry with its diverse portfolio. Its revenue streams span chips, software, and licensing. The company demonstrates steady growth, robust profitability, and a sound financial position. While valuation concerns exist, Broadcom remains an attractive long-term investment, backed by positive analyst sentiment and a bullish price target.

목차

Introduction

Broadcom Inc.: A Semiconductor Powerhouse

Broadcom is a global technology company specializing in semiconductor solutions. With a diverse portfolio spanning wired and wireless communication, storage, and industrial applications, Broadcom plays a pivotal role in shaping the tech industry.

Business Overview

Industry Leadership: Dominating the Semiconductor Landscape

Broadcom is a leader in the semiconductor industry, providing critical components for various devices. Its chips power everything from smartphones to data centers, making it an essential player in the digital ecosystem.

Diverse Portfolio: From Connectivity to Infrastructure

The company’s product range includes networking chips, storage solutions, and connectivity modules. Broadcom’s acquisitions (such as CA Technologies and Symantec) have expanded its footprint into software and cybersecurity.

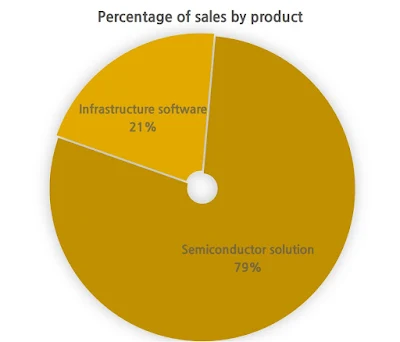

Revenue Streams: Chips, Software, and Licensing

Semiconductor Sales: Broadcom’s core business revolves around

designing and manufacturing chips.

Software and Services: Beyond hardware, it generates revenue

from software licensing and services.

Financial Metrics

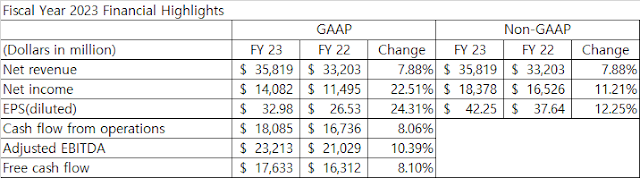

Steady Growth: Expanding Top Line

Broadcom consistently reports strong revenue growth, driven by demand for

its chips.

Its diversified product offerings contribute to stability

even during market fluctuations.

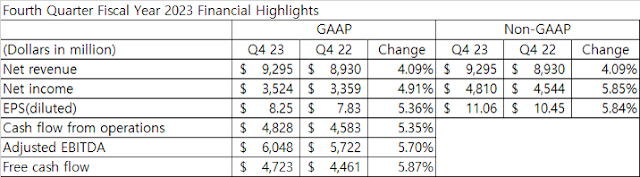

Revenue of $9,295 million for the

fourth quarter, up 4 percent from the prior year period.

Profitability: Robust Margins, Efficient Operations

The company maintains healthy profitability, with impressive margins.

Efficient

operations and cost management contribute to its bottom line.

GAAP net

income of $3,524 million for the fourth quarter; Adjusted EBITDA of $ 6,048

million for the fourth quarter.

GAAP diluted EPS of $8.25 for the

fourth quarter. Non-GAAP diluted EPS of $11.06 for the fourth quarter.

Financial Health: Balancing Debt and Liquidity

Broadcom manages its debt well, ensuring financial flexibility.

However,

investors should monitor its debt levels and liquidity ratios.

Free

cash flow from operations: $4,723 million for the fourth quarter, defined as

cash from operations of $4,828 million less capital expenditures of $105

million.

Strengths and Weaknesses

Upsides: Strong Earnings, Positive Analyst Sentiment

Earnings Margins: Broadcom’s profitability metrics are commendable.

Diverse Revenue Streams: A mix of hardware and software offerings.

Market Position: A dominant player in critical tech segments.

Challenges: Valuation Metrics, High Earnings Multiples.

Valuation Concerns: Some analysts believe the stock may be overvalued.

Earnings Multiples: High price-to-earnings ratios warrant caution.

Investment Outlook

Based on current business trends and conditions, the outlook for continuing

operations for fiscal year 2024, ending November 3, 2024, including

contributions from VMware, is expected to be as follows:

Fiscal year 2024 revenue guidance of approximately $50.0 billion.

Fiscal year 2024 adjusted EBITDA guidance of approximately 60 percent of

projected revenue.

The guidance provided above is only an estimate of what the Company believes

is realizable as of the date of this release. The Company is not readily

able to provide a reconciliation of projected Adjusted EBITDA to projected

net income without unreasonable effort. Actual results will vary from the

guidance and the variations may be material. The Company undertakes no

intent or obligation to publicly update or revise any of these projections,

whether as a result of new information, future events or otherwise, except

as required by law.

댓글 쓰기